Why SimplifyBudget Is The Financial Tracker You've Been Missing

Most people have a distorted view of their finances. They think they're saving money while simultaneously accumulating debt. They celebrate putting $500 in savings while ignoring the $700 in credit card charges from the same month. This financial self-deception isn't entirely their fault – most budgeting tools are designed to keep you in the dark.

That's why I created SimplifyBudget, a Google Sheets-based financial tracker that does something radical: it shows you the truth about your money.

The Problem With Traditional Budget Tools

Traditional budgeting apps follow a fragmented approach – they separate your "buckets" of money into isolated categories. Your savings exist in one corner, your spending in another, and your debt somewhere else entirely. This artificial separation allows you to feel good about saving while ignoring the bigger financial picture.

This isn't how financial professionals think about money. To them, it's all connected – your net worth is what matters, not artificial buckets. When you have $10,000 in savings but $15,000 in credit card debt, you don't have savings – you have negative $5,000.

Visit simplifybudget.com to get your free budget tracker!

The Integrated Approach That Changes Everything

SimplifyBudget is built on a fundamental principle: financial honesty. Instead of artificially separating your money, it shows you your true financial position by integrating:

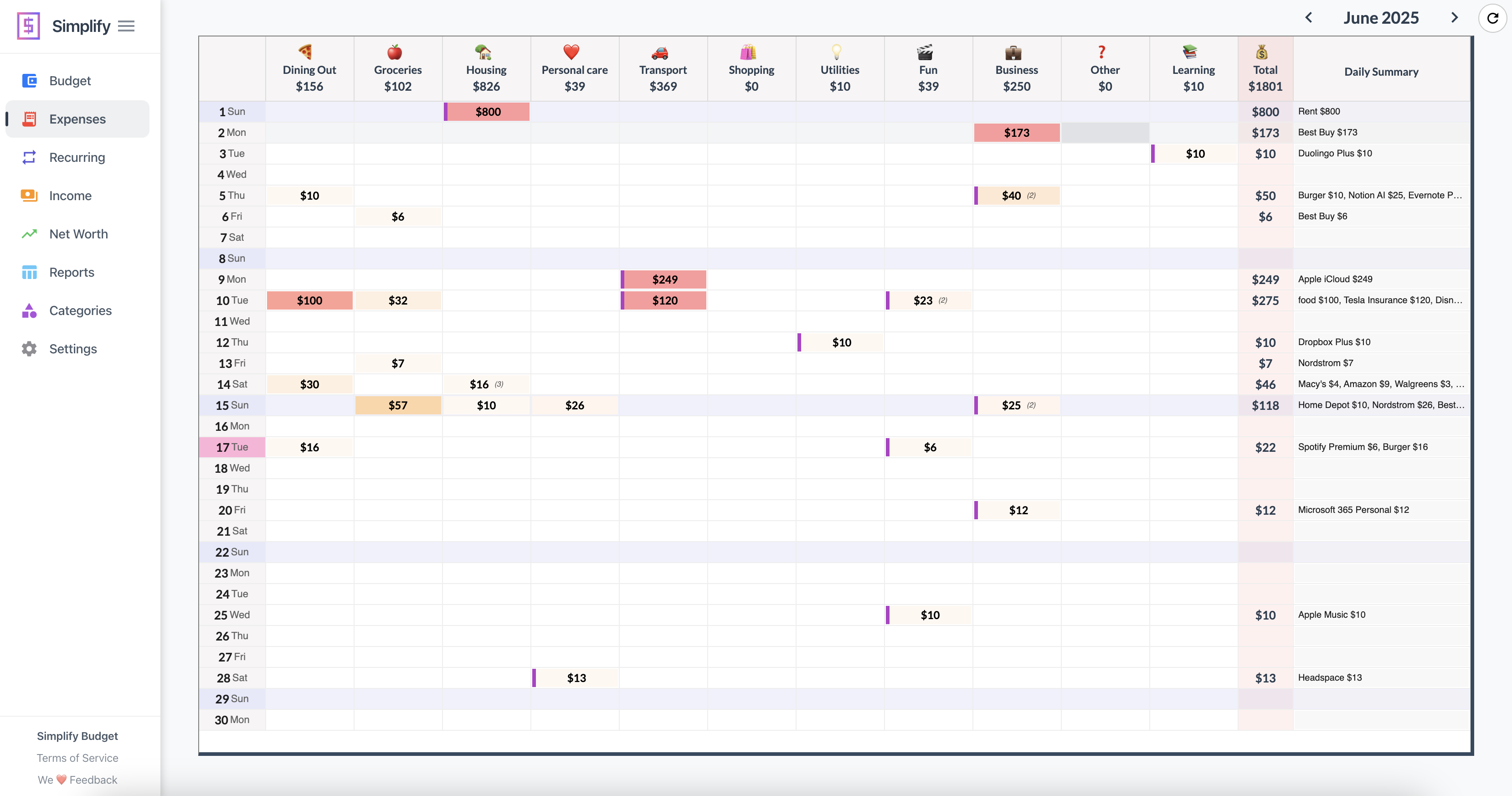

- Daily and monthly expenses

- Income tracking

- Subscription management

- Net worth calculations

- Debt monitoring

This integration creates a complete picture that reveals whether you're truly building wealth or just shuffling money around while falling behind.

Track Expenses Without The Tedium

One of the biggest reasons people abandon budgeting is the tedium of entering every transaction. SimplifyBudget's Quick Log feature solves this by allowing you to enter daily totals by category rather than individual purchases.

Had coffee, breakfast, and lunch out today? Instead of three separate entries, just enter the daily total for "Dining Out." This approach dramatically reduces the time needed to maintain your financial awareness while still giving you the insights you need.

Quick Log is perfect for those frequent, small expenses that would otherwise make tracking feel like a part-time job. You still maintain awareness without the burden of detailed entry.

Never Be Surprised By Subscriptions Again

The average person spends over $250 monthly on subscriptions they barely use. SimplifyBudget's subscription tracker helps you monitor recurring payments and visualize their impact on your finances.

The system shows upcoming payments in your monthly view and automatically tracks when they're due. You'll never be surprised by an annual renewal or wonder why your bank account is suddenly lower.

Privacy By Design

In an era of data breaches and privacy concerns, SimplifyBudget takes a refreshingly different approach. Because it's built entirely with Google Sheets formulas (not scripts), it requires no special authorizations or permissions.

Your financial data stays on your own Google Drive – no sharing, no sending to servers, no privacy concerns. You get sophisticated financial tracking without compromising your data security.

Real Financial Clarity At Last

The true power of SimplifyBudget lies in seeing the connections between different parts of your financial life:

- How subscription payments affect your monthly budget

- How daily spending impacts your ability to reduce debt

- How your true net worth changes over time

Mark, who had been using a traditional budgeting app for years, was shocked when SimplifyBudget revealed he had been treading water financially despite "saving" every month. The debt he was slowly accumulating was canceling out his savings efforts – something his previous tools never made clear.

After three months with SimplifyBudget, he had a complete picture of his finances, had eliminated two unnecessary subscriptions, and was genuinely increasing his net worth for the first time.

Start Seeing Your True Financial Picture Today

If you're tired of financial tools that hide the truth, try SimplifyBudget. It might not tell you what you want to hear, but it will tell you what you need to know to achieve genuine financial progress.

SimplifyBudget offers both free and premium versions, with the free version providing all the essential tools to transform your financial awareness.

Download SimplifyBudget today and discover what financial professionals have always known – the only way to improve your finances is to see them as they truly are.